Wells Fargo Everyday Checking Account with a $ 325 Welcome Bonus

A practical, accessible checking account with digital tools and bonus opportunities

By: Finanças do Mundo

Low Opening Deposit

Start your account with just $25, making it easy and affordable to begin managing your everyday finances.

Extensive ATM and Branch Access

Access over 10,000 Wells Fargo ATMs and thousands of branches nationwide for convenient banking support wherever you are.

$325 Welcome Bonus Opportunity

Earn a $325 cash bonus when you set up qualifying direct deposits of at least $1,000 within 90 days of account opening.

Explore the Benefits of the Wells Fargo Everyday Checking Account

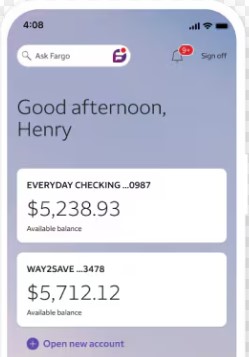

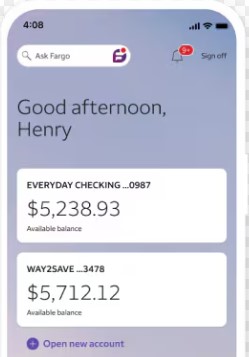

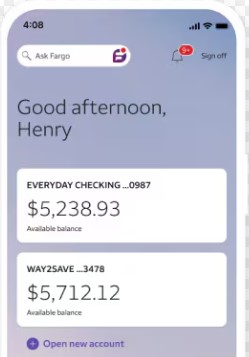

The Wells Fargo Everyday Checking Account is designed to offer a flexible and accessible banking experience for everyday needs. With a low opening deposit requirement of just $25, this account is a great entry point for anyone seeking reliable daily banking tools. Customers can easily manage their money through the Wells Fargo Mobile® app or online banking platform, with features like mobile check deposit, Zelle® for quick transfers, and bill pay options. The account provides access to over 10,000 Wells Fargo ATMs and thousands of branches nationwide, making it convenient to access funds and get assistance. Users also benefit from enhanced security, including 24/7 fraud monitoring, two-step verification, and Zero Liability protection for unauthorized transactions. A standout feature of this account is the potential to earn a welcome bonus. New customers can earn a $325 bonus by receiving at least $1,000 in qualifying direct deposits within the first 90 days of opening the account, as long as the offer is accessed through the designated promotional link or code. While the Everyday Checking Account does have a $10 monthly service fee, it can be waived by meeting certain criteria—such as maintaining a $500 minimum daily balance, having $500 or more in qualifying direct deposits, or being aged 17–24. Overall, the Wells Fargo Everyday Checking Account offers a balance between traditional and digital banking, with solid features, broad accessibility, and the chance to earn a cash bonus. It’s ideal for those looking for everyday simplicity backed by a major national bank.

-

How do I qualify for the $325 welcome bonus?

You must receive at least $1,000 in qualifying direct deposits within 90 days of account opening using the special offer link or code by July 8, 2025.

-

What is the minimum deposit to open the account?

You need a minimum of $25 to open a Wells Fargo Everyday Checking Account.

-

Can I waive the monthly service fee?

Yes, the $10 monthly fee can be waived by maintaining a $500 daily balance, having $500+ in direct deposits, or being between ages 17–24.

-

Is the account good for digital banking?

Yes, Wells Fargo provides robust digital tools, including mobile check deposit, Zelle®, bill pay, and account alerts via the mobile app or online platform.

-

Does the account include overdraft protection?

Yes, you can link eligible accounts for overdraft protection or use Extra Day Grace Period to avoid fees when overdrawn.

How to Open Your Wells Fargo Everyday Checking Account

Opening a Wells Fargo Everyday Checking Account is simple and can be done entirely online or by visiting a local branch. The process is quick and only requires a few pieces of personal and financial information to get started. First, visit the official Wells Fargo website and navigate to the Everyday Checking account page. If you're taking advantage of a welcome bonus offer, make sure to access the offer through the dedicated promotional link. You’ll begin by entering your full name, address, date of birth, Social Security number, and employment details. Then, you’ll be asked to fund your account with at least the $25 minimum opening deposit, which can be done via debit card, ACH transfer, or another Wells Fargo account. After confirming your details and submitting your application, you’ll receive a confirmation email. If approved, your new account will be active immediately, and you'll be able to enroll in online banking to start managing your funds digitally. You can also apply in person by visiting a Wells Fargo branch. Bring a government-issued photo ID and proof of address. A banker will guide you through the setup process and help you enroll in mobile and online services. Once your account is active, consider setting up direct deposit to qualify for the welcome bonus and potentially waive the monthly service fee. You can also explore additional account features such as overdraft protection, mobile alerts, and customizable debit card designs.